The conversation is a familiar one: friend who's moved out of London comes to visit and is shocked at how expensive everything is. They then espouse the wonders of their new home city declaring it to be cheaper than London. You respond that the capital may be expensive, but wages are higher than elsewhere.

But are you financially better off living in London? Here's the maths:

Cost of living

The first thing is to look at how much the basics would cost in each city. This includes rent, utilities, internet, a monthly travel card and a gym membership. One thing to note is that the cost of rent for London is calculated based on a one-bedroom flat outside the city centre, whereas for the remainder of the cities the cost of rent is modelled on a one-bedroom flat in the city centre.

There aren’t too many surprises so far — we know that London, Cambridge and Oxford are expensive places to live. So how do these compare to the average wages in each city?

Income

Adding the average income after tax into the picture starts to reveal a little more. The latest Office for National Statistics data on average wages relates to 2013, so these figures are adjusted using the inflation rate to pro rata 2015.

Interestingly, the average wages do not appear to correlate to the average cost of living for each city. Clearly the difference in income and cost of living in Edinburgh is higher than other cities, including London.

Cost of leisure

Before we draw a conclusion, it’s worth noting disposable income will only get you so far depending on which city you are in. If I had £300 in London and £300 in, say, Glasgow, then you would expect that the £300 would go a lot further in Glasgow in London.

To counteract this effect, let's adjust the actual disposable income to reflect how much it is actually worth in the city you are living in.

Let's compare the price of a three-course meal, four pints of beer and an adult cinema ticket in each city with the national average price. The average, by the way, is £43.11.

In the chart above, the cost of a three-course meal, four pints of beer and a cinema ticket in London (£58) is 35% higher than the national average

We can use these percentages to adjust the disposable income for living in each city so that we can compare the cities on a truly like-for-like basis.

Disposable income

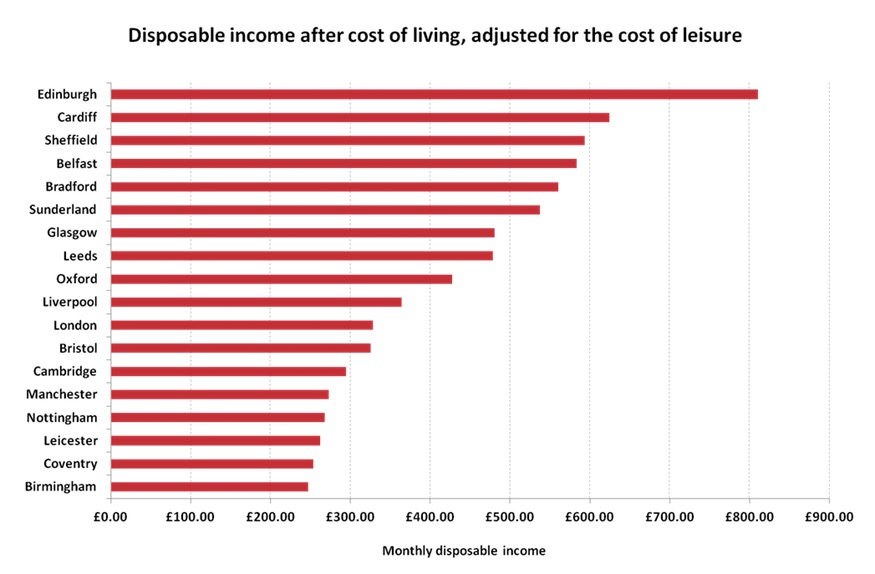

So we have found out the basic cost of living, the average income, the remaining disposable income and then adjusted that to reflect how much it costs to go out and do the things you enjoy in each city. Does living in London mean we are financially better off?

Well, it doesn’t appear so. By these calculations, we would be almost three times better off living in Edinburgh, and nearly twice as well off living in Cardiff, Sheffield or Belfast.

There are, of course, other factors to take into consideration: unemployment levels in each city; the distribution of wealth in London; the immeasurable value of living in a city you love.

We won’t be buying a one-way ticket to Edinburgh just yet but next time there's that conversation about where to live, we'll have to rely on arguments other than the higher wages.

By George Hodgson-Abbott, customer experience and analytics, Capgemini UK