Shoreditch is set for a hotel building boom the likes of which it has never experienced before.

Seven new hotels are slated to open in the area in the next two years. Taken together with large, newly-opened Ace Hotel on Shoreditch High Street, the number of new hotel rooms for the area totals more than 1,500.

The new properties include luxury offerings from Nobu Hospitality Group, which includes Hollywood star Robert De Niro as a shareholder, and the Gansevoort Hotel Group, which will build an "urban resort" with rooftop pool on its site off Curtain Road. These are joined by new additions to hip chains CitizenM and Z Hotels.

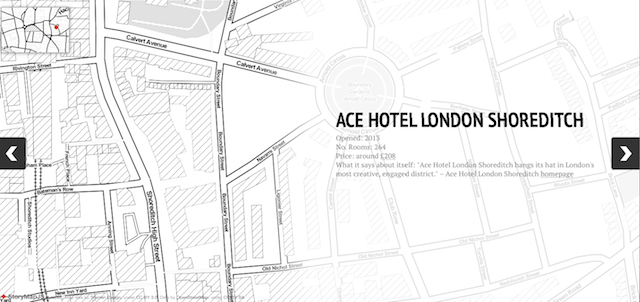

You can see the properties, plus details of where they'll be and what they'll cost on this interactive map.

Some hotels, like the Nobu property, have already begun work, demolishing the previous buildings. Its site can be seen on Willow Street, just off Great Eastern Street, with its construction hoardings regularly painted over by street artists.

Local campaigners say they are concerned that the influx of hotels could turn Shoreditch into a "transient" site. Rachel Munro-Peebles, co-chair of the Shoreditch Community Association (SCA), says:

"We have so many due to be built in the area, we wonder whether the council has forgotten about the people who live and work here, families, young couples... the extreme transient growth, along with the tsunami of licensed premises, may lose what we have to come to love so much."

The SCA says the area has suffered from an imbalanced streetscape dominated by drinking spots, while residents and tourists alike remain underserved.

"We are losing the high street here in Shoreditch — we need to see more retail which gives back to the community and to the tourists who visit here, not just a drinking area. This way tourists will spend locally and our community will flourish," says Munro-Peebles.

A request for comment to councillors of Hoxton East and Shoreditch ward, where many of the hotels are located, was not answered.

Shoreditch currently has about 700 hotel rooms from existing properties like the Hoxton, Holiday Inn Express and Premier Inn.

So why is Shoreditch attracting so much new investment from hotel operators? According to JasonD, a contributing editor at trade publication HotelChatter, the area has lagged behind the rest of London in the number of hotel beds available, and it's now playing catch-up, and fast. "Compared to other parts of the city, particularly the more traditional tourist areas such as the West End, it has had fewer hotels. Because [Shoreditch] is an area that has been in development, it's probably easier to find suitable sites," he said.

While developers' interests play a part in homing in on Shoreditch as a lucrative hotels niche, the hotel boom in the area is also down to demand, often triggered by local residents and workers. "In the end, just as the urban hipster and creative set has been flocking to Shoreditch to live and work, the hotels that cater to them are following," said HotelChatter's contributing editor.

The planned developments for Shoreditch are just the tip of the iceberg, if research from property consultants GVA is anything to go by. The firm finds that more than a quarter of all planned hotel beds for the city are in the City, Tower Hamlets and Newham.

According to GVA, the City and Tower Hamlets have the largest "pipelines" of hotel rooms: that is, properties with planning consent or under construction, with 2,428 and 2,608 beds respectively.

In fact, Tower Hamlets has 4,800 beds in total, if hotels at the application and pre-application stages are taken into account. According to GVA, this accounts for 12% of all of London's planned additional beds until 2031.

One of the reasons for this shift, GVA says, is because land values have risen in the traditional tourist areas of the West End, driven by residential developers, luxury retailers and arts venues. Hotels are left to compete for a smaller slice of properties with office buildings. As a result, hotel operators are drifting east, to the "growing East London city fringe market", according to GVA.

The hotel boom is accompanied by plans for a number of huge mixed-use projects, like the Bishopsgate Goodsyard development, which will see a series of towers built along the site off Bethnal Green Road. Academics studying the area have called it the 'Canary Wharf-isation' of Shoreditch.

Even as hoteliers eye the eastern boroughs, that's not to say the properties bring no benefits to the area. As Munro-Peebles of the SCA notes, the hotels can create effects that members of her group welcome. "Some of the recent hotels have brought a fantastic positive to the area like the Ace Hotel, using local startup businesses on the retail frontage and sourcing local food and drinks producers," she said.

By Joon Ian Wong